Medicare, the health care partnership between private insurance companies, pharmaceutical manufacturers and the government to protect the health of people over 65 (or with certain disabilities) is promoted as the solution to health care coverage for Americans of all ages. At 69, and dealing with Medicare now for a few years, I find this idea appalling, especially since the only solution to protecting the health of the old and the sick is a single payer system that cuts out all the parasitic middle men who profit off disease and our legitimate fear of death.

Citizens of a democracy deserve decent health care as a right of citizenship, like in every other wealthy economy (and formerly Iraq, Libya and other third world “shitholes”). But, lest I forget, America is exceptional.

Every year, between October 15 and December 7 (a day that always lives in infamy now, thanks to Medicare) purchasers of Medicare insurance are urged to shop on the marketplace and find the best suited plans for themselves. You can compare prices and, in some cases, actual coverage. It is no fun navigating the website, shopping for the best “deal” that should be provided to you automatically as a lifelong tax payer. Each of us should get the best deal available from our government, the one we fund, the one that is supposed to watch out for our best interests.

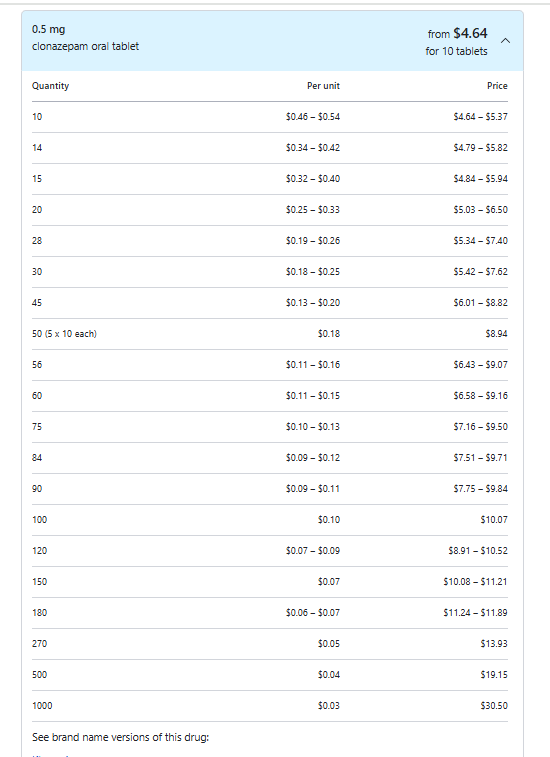

The economic reality is that, in a consumer society, if you need a few pills, you will pay 50 cents each. If you buy a billion pills, the price is 3 cents each. This is simple capitalism, economy of scale. The more you buy, the less each one will cost you [1]. Medicare buys a trillion pills a year, but is prevented, by a right wing/corporate law signed by Dubya, from negotiating prices with pharmaceutical companies based on that economy of scale leverage.

And so old people are forced to enter this kind of virtual mall, after October 15th of each year, where you can search for the best deals before the annual December 7th final deadline comes crashing down and you can choose nothing until the following October 15th rolls around because, fair is fair and rules are rules.

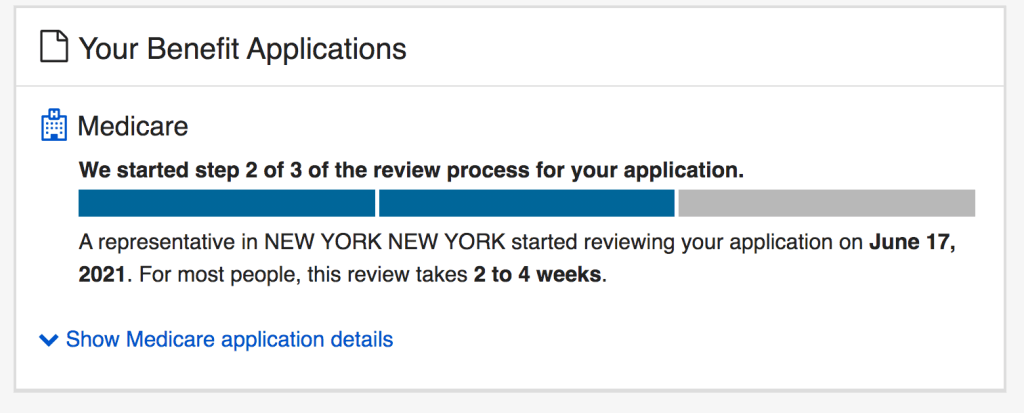

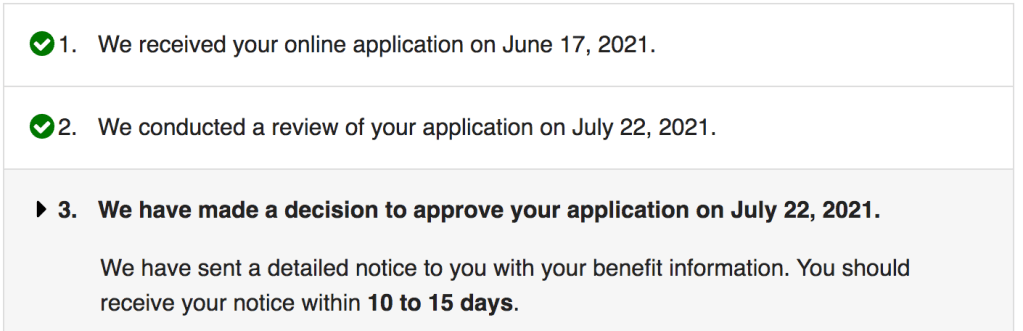

Part D of the alphabet soup that is Medicare is the prescription drug plan and every Medicare recipient must choose a Part D plan (or get it included in the problematic, loophole-ridden, insurance company sponsored Medicare plans known as Medicare Advantage). Prices for Part D vary wildly. In 2024 I chose the cheapest drug plan available, Aetna Silverscript, for $31 a month. Then:

You see profit margins here that would make Jeff Bezos and Elon Musk insanely jealous. Over 100% price increase in 2025 and then, a tic below another 100% price increase the following year. All perfectly legal here in the land of the free and the home of the brave, as long as you get a letter from that corporation informing you that your premiums will double and you will get only slightly less coverage.

A billionaire named Mark Cuban set up a company called CostPlus that will mail you prescription drugs, at 15% above cost plus handling and mailing. You can calculate the approximate cost on their website. The four generic prescription drugs I take will cost under $100 every three months, less than $400 for the year. No deductible, no insurance, just the prescriptions. I signed up online. There is a form for my doctor to submit to them, and the drugs will be shipped to me every ninety days.

I called Aetna to cancel my Part D with them, after visiting the marketplace and seeing annual prices, under our American “freedom of choice”, from $1,000 to $3,000 for the identical drugs (cost of drug copays plus premiums). My once modest $31/month plan was now up there with some of the most expensive. The woman I spoke to at Aetna was lovely, but she was not a trained disenrollment specialist, she explained, and so couldn’t take my cancellation order. She gave me another number to call to speak to a “Medicare disenrollment specialist”, and after checking, at my request, confirmed it is a 24/7 number.

In the wee hours of the morning I decided to make the last aggravating December 7th related call of the year and get that particular pile of steaming scats off my plate. When I called the 800 number it came up like so:

Who the fuck is Valley Organized Physicians? Fuck if I know, but they answer the phone “Medicare”. The person I spoke to patched me through to a disenrollment specialist named Kevin. Kevin and I wound up talking for almost an hour. He somehow had instant access to every prescription drug I’d bought in the last three years. His job, apparently, was to sell me a Part D plan, as I learned when he read me the complete list, suggesting that some, if not many, would be hard to get without insurance.

Kevin warned me that unless I enrolled in a Part D program with creditable coverage that met the minimum standards of Medicare, I’d be subject to a potentially large lifetime monthly fine that would add several dollars, or even a hundred or more, to my monthly premium in perpetuity should I need Part D coverage in the future.

I told Kevin I had no idea what “creditable” meant in that context and he explained. If the prescription drug program you enroll in is not recognized by Medicare, it’s not creditable and you will pay a monthly fine for the rest of your life if you cancel a creditable plan at any time during your years on Medicare. Way to watch out for the old and vulnerable, you fucking corporate psychopaths, I thought. But since Kevin was being so nice, we continued to amiably bat the ball back and forth.

Kevin laid out the worst case scenario to make me understand the risk I was taking by going with a non-creditable plan. Say in five years you decide you need Part D, for some expensive medication, let’s say (which, admittedly, Part D might not cover, but exceptions can sometimes be made for medical necessity). Well, currently the penalty is 39 cents a month times twelve (since you can only fix this once a year). That penalty number keeps going up. So in five years time, Kevin told me, I could be looking at a penalty of maybe $50 a month, maybe $100.

I pointed out that if I realized it was a mistake to opt for CostPlus and bought a Part D plan at the next available date (October 15, 2026) I’d pay $4 a month penalty for the rest of my life. Meantime, Aetna had increased their premium price for their basic plan 100% one year and 100% the following year. I asked him how it was possible that an insurance company can double its rate year after year with no regulation by Medicare.

Kevin had an answer worthy of a Republican congressman speaking to a FOX audience, there are many factors, market forces, which are impossible to regulate, or predict, or even consider, he told me. In other words it’s hard to say and above our pay grades to understand or do anything about. I told him it was not hard to say that costs for Aetna had not increased 200% in two years.

I expressed dismay that Medicare imposed no regulations on what private insurance companies could charge. He agreed that it was not unreasonable for me to be dismayed, but that there was a reason, somehow, beyond our feeble human understanding, apparently, that corporations can’t be regulated but consumers must be charged lifetime penalties for not buying creditable plans from approved insurance companies providing benefits consistent with the minimum standards of Medicare Part D.

Kevin told me to look for a zero cost Part D plan, then checked and said there were none available in my area. He tried to sell me a $35 a month plan, from Healthspring Assurance, which, with the drugs, would cost me only about $720 a year. He agreed there was no guarantee that Healthspring wouldn’t double its premium next year, but that’s why there is a period to compare prices once a year and the requirement of a letter informing the customer that the price was about to double.

He was trying to help me out, he said, after explaining he could have disenrolled me as soon as I called, but he was warning me of the potentially dire consequences of uncreditable disenrollment. I said that in dollars and cents, the difference between $300-400 a year for generic prescriptions, and even the bargain price of $720, would seem to more than offset the penalty for a year or two.

Eventually, after a long chat, he told me he would disenroll me. There was no confirmation number, no proof we’d ever had a conversation of almost an hour (except on my phone, but again, who the hell is Valley Organized Physicians?), I’d get a letter from Aetna confirming I’d been disenrolled, he told me. We bid each other a polite goodnight.

We got off the phone, it was now 4 a.m., and my head immediately fucking exploded. Every narcissist I’ve ever known has told me I’m too sensitive. Maybe the despicable freaks are right about that. I was unable to tune down my outrage enough to get to sleep, the pill I took at 5:00 allowed me to finally drift off around 6:30 a.m. for a few hours of sleep. I’m too sensitive, goddamn it, and it’s messing with my health.

[1]